Where Can I Get a Prepaid Visa Card?

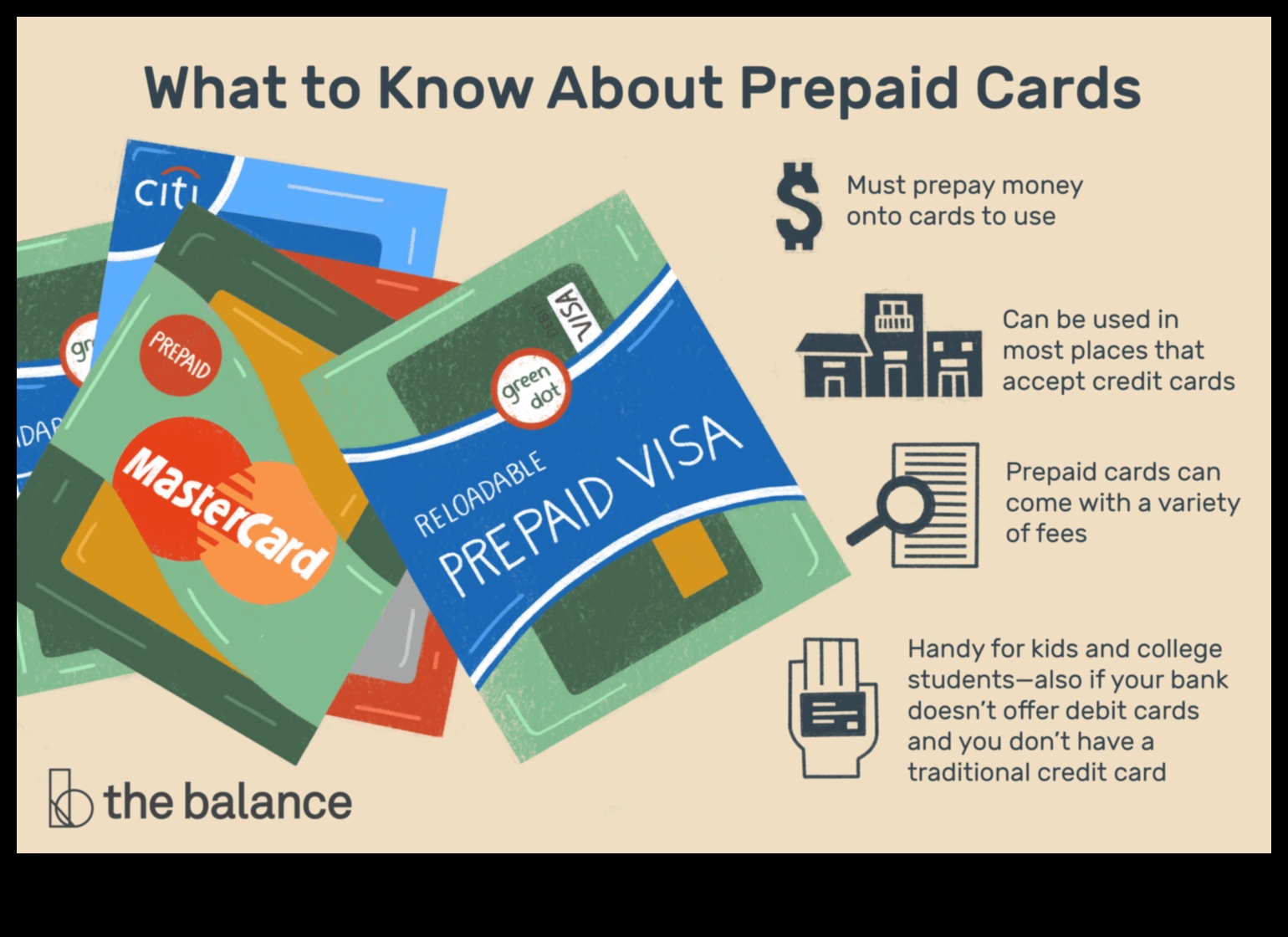

A prepaid Visa card is a reloadable card that can be used to make purchases online, in stores, and over the phone. It is similar to a debit card, but it does not require a bank account.

There are many places where you can buy a prepaid Visa card. Some of the most popular options include:

- Banks

- Convenience stores

- Online retailers

- Supermarkets

To buy a prepaid Visa card, you will need to provide some personal information, such as your name, address, and date of birth. You will also need to make a deposit, which can be anywhere from $10 to $500.

Once you have purchased a prepaid Visa card, you can use it to make purchases just like you would use a regular credit card. You can also use it to withdraw cash from ATMs.

There are a few things to keep in mind when using a prepaid Visa card. First, you need to be aware of the fees that are associated with the card. Some cards charge a monthly fee, a transaction fee, or a cash withdrawal fee. Second, you need to make sure that the card is accepted at the merchant where you want to use it.

Overall, prepaid Visa cards can be a convenient and affordable way to make purchases online, in stores, and over the phone. However, it is important to be aware of the fees and limitations associated with the card before you use it.

| Feature | Buy prepaid Visa card | Order prepaid Visa card | Reload prepaid Visa card | Activate prepaid Visa card |

|---|---|---|---|---|

| What is it? | A prepaid Visa card is a card that you can use to make purchases online or in stores. You can load money onto the card in advance, and then use it to pay for things. | To order a prepaid Visa card, you can visit the website of a prepaid card provider. You will need to provide some personal information, such as your name, address, and Social Security number. You will also need to choose how much money you want to load onto the card. | To reload a prepaid Visa card, you can visit the website of the card provider or call customer service. You will need to provide the card number and the amount of money you want to reload. | To activate a prepaid Visa card, you will need to call customer service or visit the website of the card provider. You will need to provide the card number and the activation code that was included with the card. |

II. What is a prepaid Visa card?

A prepaid Visa card is a card that is loaded with a specific amount of money that can be used to make purchases. The card is not connected to a bank account, and the funds on the card cannot be overdrafted. Prepaid Visa cards are often used for online purchases, as they can be used to avoid having to enter your credit card number on a website. They can also be used for sending money to friends or family, or for making purchases in stores that do not accept credit cards.

Prepaid Visa cards are available from a variety of sources, including banks, grocery stores, and online retailers. The fees associated with prepaid Visa cards vary depending on the issuer, but typically include a purchase fee, a monthly fee, and a fee for each transaction.

Prepaid Visa cards can be a convenient way to make purchases, but it is important to be aware of the fees associated with the card before you use it.

III. Benefits of using a prepaid Visa card

There are many benefits to using a prepaid Visa card, including:

Convenience: Prepaid Visa cards are easy to use and can be used anywhere that accepts Visa cards. You don’t need to have a bank account or credit history to get a prepaid Visa card, and you can usually purchase one at a variety of retailers.

Security: Prepaid Visa cards are more secure than cash or checks, as they can’t be lost or stolen. If your prepaid Visa card is lost or stolen, you can simply cancel it and get a new one.

Control: Prepaid Visa cards allow you to control your spending. You can only spend the amount of money that is loaded onto the card, so you can’t go into debt. This can be a great way to budget your spending and save money.

Flexibility: Prepaid Visa cards can be used for a variety of purposes, including online shopping, making payments, and withdrawing cash. You can also use them to get cash back on purchases, which can save you money.

Overall, prepaid Visa cards are a convenient, secure, and flexible way to pay for purchases. They are a great option for people who don’t have a bank account or credit history, or for people who want to control their spending.

IV. How to buy a prepaid Visa card

There are a few different ways to buy a prepaid Visa card. You can purchase them online, at retail stores, or from some banks.

To purchase a prepaid Visa card online, you can visit the website of a prepaid card provider such as prepaidcardservice.com or netspend.com. You will need to provide your name, address, and other personal information. You will also need to choose the amount of money you want to load onto the card. Once you have completed the purchase, you will receive a card number and PIN that you can use to start spending.

To purchase a prepaid Visa card at a retail store, you can find them at most major retailers such as Walmart, Target, and CVS. You can also purchase them at some convenience stores and gas stations. When you purchase a prepaid Visa card at a retail store, you will need to provide your name, address, and other personal information. You will also need to pay for the card in cash or with a credit card. Once you have completed the purchase, you will receive a card number and PIN that you can use to start spending.

To purchase a prepaid Visa card from a bank, you can visit your local branch or call the bank’s customer service line. You will need to provide your name, address, and other personal information. You will also need to pay for the card with a checking account or savings account. Once you have completed the purchase, you will receive a card number and PIN that you can use to start spending.

5. Where to buy a prepaid Visa card

There are many different places where you can buy a prepaid Visa card. Some of the most popular options include:

- Online retailers

- Convenience stores

- Banks

- Supermarkets

- Gift card retailers

When choosing a place to buy a prepaid Visa card, it is important to consider the following factors:

- Convenience

- Price

- Reputation

For example, if you need a prepaid Visa card quickly, you may want to buy it from an online retailer or a convenience store. However, if you are looking for the best price, you may want to consider buying it from a bank or a supermarket. And if you are concerned about the reputation of the company you are buying from, you may want to buy it from a gift card retailer.

Once you have chosen a place to buy a prepaid Visa card, you can follow these steps to complete the purchase:

- Select the amount of money you want to load onto the card.

- Provide your personal information, such as your name, address, and phone number.

- Pay for the card.

- Receive the card.

Once you have received your prepaid Visa card, you can use it to make purchases anywhere that accepts Visa cards.

How to use a prepaid Visa card

Prepaid Visa cards can be used to make purchases online, in stores, and over the phone. To use a prepaid Visa card, simply follow these steps:

- Enter the card number, expiration date, and security code on the checkout page.

- If prompted, enter the cardholder’s name.

- Click “Submit” or “Purchase” to complete the transaction.

Prepaid Visa cards can also be used to withdraw cash from ATMs. To do this, simply insert the card into the ATM and enter your PIN. Select the amount of cash you would like to withdraw and follow the on-screen instructions.

Prepaid Visa cards are a convenient and safe way to make purchases online and in stores. They are also a great way to send money to friends and family or to use as a gift card.

VII. Safety precautions when using a prepaid Visa card

When using a prepaid Visa card, it is important to take precautions to protect yourself from fraud. Here are some tips:

- Never share your card number or PIN with anyone, not even family or friends.

- Be careful when using your card online. Only shop at reputable websites that use secure encryption.

- Keep your card in a safe place, and never leave it unattended.

- If you lose your card, report it immediately to the card issuer.

By following these tips, you can help protect yourself from fraud and enjoy the benefits of using a prepaid Visa card safely.

FAQ

This section answers common questions about prepaid Visa cards.

Q: What is a prepaid Visa card?

A prepaid Visa card is a reloadable card that can be used to make purchases online, in stores, and over the phone. The card is funded with money that you load onto it, and you can use it until the balance is depleted.

Q: What are the benefits of using a prepaid Visa card?

There are many benefits to using a prepaid Visa card, including:

No credit check required. You don’t need to have good credit to get a prepaid Visa card.

No monthly fees. Many prepaid Visa cards don’t charge monthly fees.

Easy to use. Prepaid Visa cards are easy to use and can be used anywhere that Visa is accepted.

Convenient. You can reload your prepaid Visa card online, over the phone, or at participating retailers.

Q: Where can I buy a prepaid Visa card?

You can buy a prepaid Visa card at many different retailers, including:

Grocery stores

Convenience stores

Drugstores

Banks

Online

Q: How do I use a prepaid Visa card?

To use a prepaid Visa card, you simply need to enter the card number, expiration date, and security code when making a purchase. You can also use your prepaid Visa card to withdraw cash from an ATM.

Q: How do I reload my prepaid Visa card?

You can reload your prepaid Visa card online, over the phone, or at participating retailers. To reload your card online, you will need to provide your card number and the amount you want to reload. To reload your card over the phone, you will need to call the customer service number on the back of your card. To reload your card at a participating retailer, you will need to provide your card number and the amount you want to reload.

Q: What are the safety precautions I should take when using a prepaid Visa card?

When using a prepaid Visa card, it is important to take the following safety precautions:

Never share your card number, PIN, or security code with anyone.

Be careful when making online purchases. Only shop at reputable websites that use secure encryption.

Keep your card in a safe place. Don’t leave your card unattended or in your car.

Report lost or stolen cards immediately. If you lose or steal your card, you should report it to the card issuer immediately.

Q: What are the fees associated with using a prepaid Visa card?

There are some fees associated with using a prepaid Visa card, including:

Activation fees

Reload fees

Transaction fees

Foreign transaction fees

Q: What is the difference between a prepaid Visa card and a debit card?

A prepaid Visa card is a type of debit card, but there are some key differences between the two. A prepaid Visa card is funded with money that you load onto it, while a debit card is linked to your bank account. This means that you can only use a prepaid Visa card for purchases that you have already funded, while you can use a debit card for purchases that you don’t have the funds for. Additionally, prepaid Visa cards typically have higher fees than debit cards.

Q: What is the difference between a prepaid Visa card and a credit card?

A prepaid Visa card is a type of debit card, while a credit card is a type of loan. This means that when you use a prepaid Visa card, you are using your own money, while when you use a credit card, you are borrowing money from the credit card company. This has a number of implications, including:

Prepaid Visa cards don’t have credit limits. You can only use a prepaid Visa card for the amount of money that you have loaded onto it.

Prepaid Visa cards don’t charge interest. You

IX. Conclusion

Prepaid Visa cards can be a convenient and affordable way to make purchases online or in stores. They are also a good option for people who do not have a credit card or bank account. However, it is important to use prepaid Visa cards responsibly and to be aware of the risks involved.

Here are some tips for using prepaid Visa cards safely:

- Only use prepaid Visa cards for purchases that you can afford.

- Keep your prepaid Visa card number and PIN safe.

- Be aware of the fees associated with using a prepaid Visa card.

- Read the terms and conditions of your prepaid Visa card before using it.

If you have any questions about using a prepaid Visa card, you can contact the card issuer directly.

FAQ

Q: What is the difference between a prepaid Visa card and a credit card?

A: A prepaid Visa card is a card that you purchase with cash or a bank account and then load with money. You can use it to make purchases anywhere that accepts Visa cards. A credit card, on the other hand, is a card that you borrow money from a bank to make purchases. You are then required to pay back the money you borrowed, plus interest.

Q: How do I use a prepaid Visa card?

A: To use a prepaid Visa card, you simply swipe it or insert it into the card reader at the point of sale. You will then be prompted to enter your PIN number. If you do not have a PIN number, you can usually create one at the time of purchase.

Q: How do I reload a prepaid Visa card?

A: You can reload a prepaid Visa card at most major retailers, such as Walmart, Target, and CVS. You can also reload your card online or through the phone.